Turkey, a neighboring country of Iran in Western Asia, is also among the top steel producers globally. However, the development of the steel industry in Turkey differs from that of Iran. Unlike Iran, Turkey does not have significant iron ore reserves, and energy is expensive. Nonetheless, Turkey’s strategic location as a gateway to European trade, coupled with its focus on scrap-based steel production to reduce energy consumption, has made its steel industry competitive and a key pillar of its economy.

A comparison of the steel industries in Iran and Turkey may initially suggest competition between the two sectors. Although Turkish and Iranian steelmakers compete in certain target markets, the distinct development paths and inherent advantages of each industry create opportunities for collaboration despite the competition. In fact, the steel industries of Iran and Turkey can complement each other in the production chain.

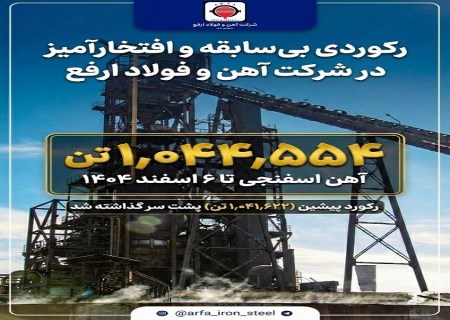

Iran’s vast mineral resources offer an opportunity for entities within the steel chain to become suppliers of raw materials to Turkish steel plants. Turkish steelmakers, for instance, could meet some of their smelting needs with sponge iron produced in Iran’s reduction units. This would allow Iran to find a competitive market for its surplus production while Iranian steelmakers could use this opportunity to modernize their technology and focus on producing higher value-added steel products. There are numerous opportunities to expand trade between Iran and Turkey.

Iran and Turkey are significant trading partners. In the first four months of this year, 13% of Iran’s non-oil imports came from Turkey. Turkey is Iran’s second-largest source of imports, after China. Similarly, 13% of Iran’s non-oil exports during the same period were destined for Turkey, making Turkey an important market for Iran’s non-oil products. China, Iraq, and the United Arab Emirates are Iran’s other major non-oil export markets, with Iran ranking fourth in terms of export value.

Trade relations with neighboring countries offer numerous advantages, including easier commercial exchanges, enhanced regional security, reduced transportation costs, and more. Following the imposition of the most severe U.S. sanctions on Iran since 2018, policymakers have increasingly focused on expanding trade relations between Iran and its neighbors. Strengthening Iran’s presence in the competitive markets of neighboring countries requires support for domestic production, diversifying the export product portfolio based on neighbors’ needs, fostering bilateral or multilateral relations, and expanding joint ventures with neighboring countries.

Despite the importance of expanding trade interactions with regional countries, it is important to note that lifting sanctions and removing Iran from the FATF blacklist would significantly enhance Iran’s presence in regional markets. Neighboring countries are often tied to third-party trading partners, making it difficult for them to trade with Iran. Additionally, the lack of direct financial and banking interactions increases trade costs.

Iran’s key export destinations in 2023 included China ($13.9 billion), Iraq ($9.2 billion), the United Arab Emirates ($6.6 billion), Turkey ($4.2 billion), and India ($2.2 billion). According to data from the Islamic Republic of Iran Customs Administration, 65% of Iran’s non-oil exports in the first four months of this year were directed to China, Iraq, the UAE, Turkey, and Afghanistan. From the start of the year until the end of July, the top five export destinations for Iranian goods were China ($4.778 billion), Iraq ($3.622 billion), the UAE ($2.365 billion), Turkey ($1.679 billion), and Afghanistan ($701 million).

Increasing industrial trade cooperation between Iran and Turkey can pave the way for the industrial development of both countries.

Berdia Amirtimori/editor